Business Insurance in and around Louisville

Louisville! Look no further for small business insurance.

Insure your business, intentionally

Help Prepare Your Business For The Unexpected.

Whether you own a a cosmetic store, a clock shop, or a bakery, State Farm has small business coverage that can help. That way, amid all the various options and moving pieces, you can focus on making this adventure a success.

Louisville! Look no further for small business insurance.

Insure your business, intentionally

Customizable Coverage For Your Business

When one is as enthusiastic about their small business as you are, it is understandable to want to make sure all systems are a go. That's why State Farm has coverage options for artisan and service contractors, commercial auto, business owners policies, and more.

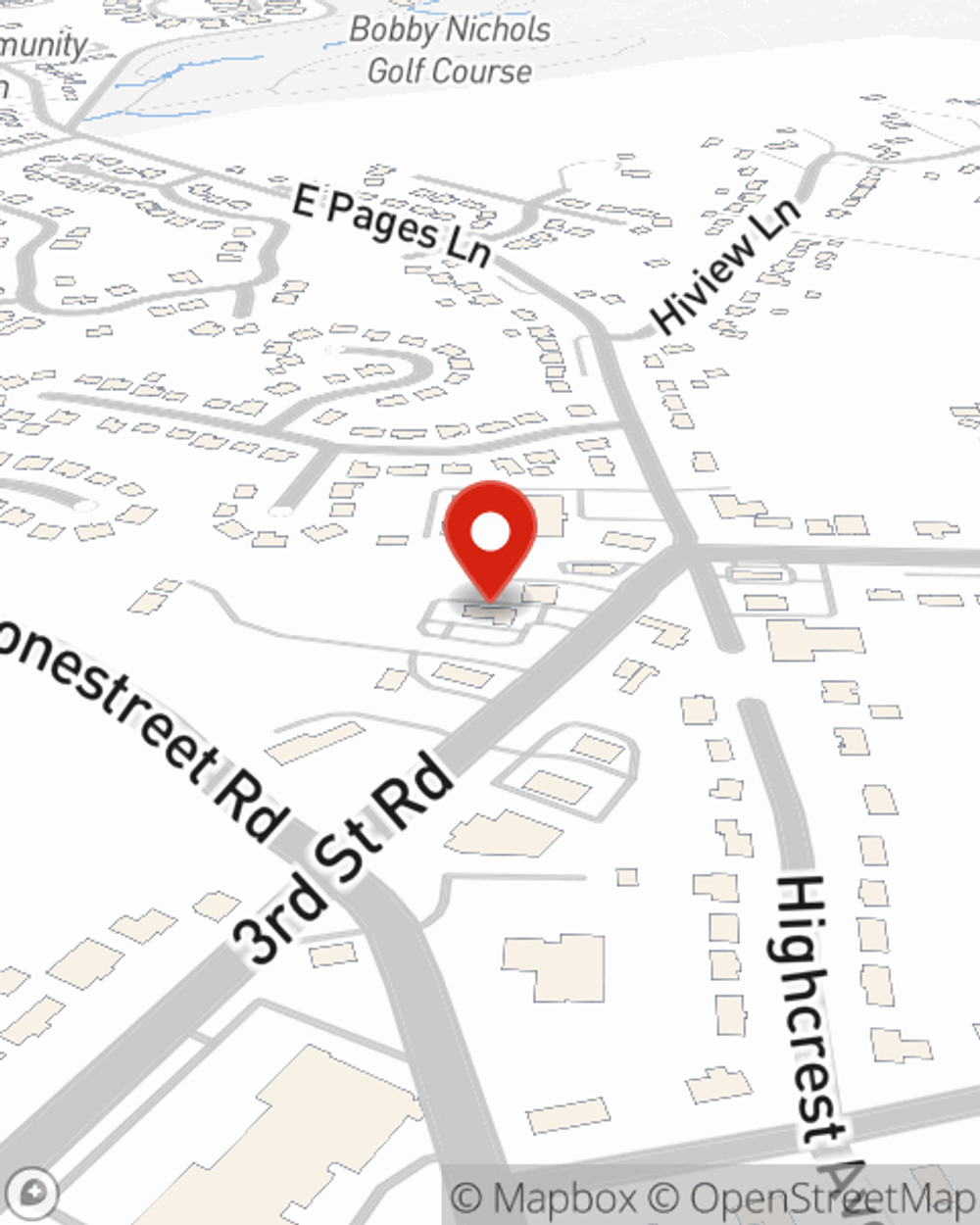

As a small business owner as well, agent Karla Lovewell understands that there is a lot on your plate. Call or email Karla Lovewell today to talk over your options.

Simple Insights®

Steps to start a small business

Steps to start a small business

Starting a small business can be exciting and challenging. Use this guide to help turn your idea into a successful business.

Consider a Simplified Employee Pension plan for your small business

Consider a Simplified Employee Pension plan for your small business

Simplified Employee Pension IRA (SEP IRA) plans are employee IRAs funded by tax-deductible contributions from small business employers.

Karla Lovewell

State Farm® Insurance AgentSimple Insights®

Steps to start a small business

Steps to start a small business

Starting a small business can be exciting and challenging. Use this guide to help turn your idea into a successful business.

Consider a Simplified Employee Pension plan for your small business

Consider a Simplified Employee Pension plan for your small business

Simplified Employee Pension IRA (SEP IRA) plans are employee IRAs funded by tax-deductible contributions from small business employers.